Wednesday, April 30, 2014

Monday, April 28, 2014

Choosing To Have A Middle Class - Thom Hartmann

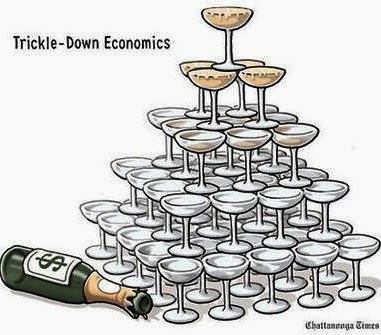

Despite what you might read in the Wall Street Journal or see on Fox News (both owned by Rupert Murdoch), capitalism is not an economic system that produces a middle class.

In fact, if left to its own devices, capitalism tends towards vast levels of inequality and monopoly. Wealth accumulates at the very top among the elites, not among everyday working people. Inequality is the default option.

By embracing Reaganomics and cutting taxes on the rich, we decided back in 1980 not to have a middle class within a generation or two. George H.W. Bush saw this, and correctly called it "Voodoo Economics."

When we had heavily regulated and taxed capitalism in the post-war era, the largest employer in America was General Motors, and they paid working people what would be, in today's dollars, about $50 an hour with benefits. Reagan began deregulating and cutting taxes on capitalism in 1981, and today, with more classical "raw capitalism," what we call "Reaganomics," or "supply side economics," our nation's largest employer is WalMart and they pay around $10 an hour.

This is how quickly capitalism reorients itself when the brakes of regulation and taxes are removed - this huge change was done in less than 35 years.

The full article is available here

Saturday, April 26, 2014

Middle Class Broke Because Of Government Policy Dictated By Plutocracy - Egberto Willies

As productivity increased in this country, and employees provided more value, only those at the top that got the spoils.

If one watches corporate media, the impression is given that the free market as the best allocator of resources if left unfettered is the solution to all that ails the country’s economy. This god, the free market, will ensure that productivity and efficiency are rewarded.

Additionally one's wage is somehow proportional to their worth within the economy.

The wealth of most Americans has been in a state of stagnation since the institution of Ronald Reagan’s supply side economics (termed "voodoo economics" by George HW Bush) that America is still living under. Until this form of economics is disbanded and corrective action taken via the tax system, the middle class will continue to falter and the Plutocracy will continue its unfettered reign.

As productivity increased in this country, and employees provided more value, only those at the top that got the spoils. These are theories intent to keep a class system in which a very select few control most of the capital and the government.

Firstly, there is no free market. Corporations are grabbing patents or acquiring patents left and right however dubious the claims. Farmers are losing their ability to grow their crops free with their own seeds, because of cross pollination with genetically modified seeds of major corporations who own the patent on those seeds.

Secondly, while politicians are elected democratically, they are generally elected on false premises. The fact the mainstream news media is controlled by a few companies, means that the messaging heard by Americans are corporate-centric. As such, only politicians that toe the line tend to get the ability to get a message out that can get them elected.

Thirdly, the current tax structure mathematically ensures the demise of the middle class. This is a mathematical fact. The working person’s income comes mostly from wages. The wealthy person’s income comes mostly from municipal bonds and capital gains. Wages are taxed at up to 39% and municipal bonds interest is not taxed at all while capital gains are taxed at 15%. It is a mathematical impossibility that the wealthy will not continue to get a very disproportionate take of the pie.

The full article is available here

If one watches corporate media, the impression is given that the free market as the best allocator of resources if left unfettered is the solution to all that ails the country’s economy. This god, the free market, will ensure that productivity and efficiency are rewarded.

Additionally one's wage is somehow proportional to their worth within the economy.

The wealth of most Americans has been in a state of stagnation since the institution of Ronald Reagan’s supply side economics (termed "voodoo economics" by George HW Bush) that America is still living under. Until this form of economics is disbanded and corrective action taken via the tax system, the middle class will continue to falter and the Plutocracy will continue its unfettered reign.

As productivity increased in this country, and employees provided more value, only those at the top that got the spoils. These are theories intent to keep a class system in which a very select few control most of the capital and the government.

Firstly, there is no free market. Corporations are grabbing patents or acquiring patents left and right however dubious the claims. Farmers are losing their ability to grow their crops free with their own seeds, because of cross pollination with genetically modified seeds of major corporations who own the patent on those seeds.

Secondly, while politicians are elected democratically, they are generally elected on false premises. The fact the mainstream news media is controlled by a few companies, means that the messaging heard by Americans are corporate-centric. As such, only politicians that toe the line tend to get the ability to get a message out that can get them elected.

Thirdly, the current tax structure mathematically ensures the demise of the middle class. This is a mathematical fact. The working person’s income comes mostly from wages. The wealthy person’s income comes mostly from municipal bonds and capital gains. Wages are taxed at up to 39% and municipal bonds interest is not taxed at all while capital gains are taxed at 15%. It is a mathematical impossibility that the wealthy will not continue to get a very disproportionate take of the pie.

The full article is available here

Tuesday, April 15, 2014

7 Facts About Our Broken Tax System - George Zornick in The Nation

Here are some actual facts about our tax system.

Conservative politicians and corporate lobbyists (coincidence, right?) have constructed a highly effective narrative about taxes. It is a governmentaphobia that enlists the very people hurt by its advancement. In many ways it has come to be taken for granted as common knowledge.

However, this does not mean that it is any way accurate, factual or backed by data, events or statistics. Here are some actual facts about our tax system to burst that fictitious balloon.

1. We don’t have a progressive tax system. A truly progressive tax system would ask those who are the most well-off in America to contribute the largest share of their income in taxes. Our federal taxes are progressive, but when you account for state, local and sales taxes, top-line taxation rate isn’t really progressive at all.

2. We’re one of the least-taxed countries in the world. Though the animating impulse of much of conservative politics is that we’re over-taxed, total government receipts are less in the United States than they are in any other member of the Organization for Economic Co-operation and Development, as a percent of GDP.

3. Not many companies pay the corporate tax rate—and some don’t pay any corporate taxes at all. Politicians and corporate lobbyists are fond of saying the US corporate tax rate of 35 percent is the highest in the world, which is technically true—but thanks to expansive tax loopholes, many corporations don’t pay nearly that much.

4. Some of your tax dollars are given to hugely profitable companies. Many companies have a negative tax rate—meaning they actually get money from the government. This can come in the form of federal tax breaks and other preferential treatment of certain financial instruments. Then consider the subsidies given directly to industry, along with the safety net programs some of these companies force employees to rely on, and the number gets quite big.

5. Meanwhile, some people are actually taxed into poverty. Many high-profile conservatives like to complain about their supposedly oppressive tax rates. But there’s one group—low-wage childless adults—who can literally be taxed into poverty.

6. Washington doesn’t like to address the deficit by raising taxes. There has been quite a bit of deficit reduction talk—and action—since 2008. Despite the fact that, as noted, government receipts in the United States are extremely low, a vast majority of the savings that DC has found has come from cutting things, not raising more revenue.

7. Much More Revenue Is Out There. In order to raise more tax revenue, corporations paying negative tax rates are a logical place to start, as are the very wealthy. They are the only ones seeing their income increase, rather than decrease.

The full article is available here

Conservative politicians and corporate lobbyists (coincidence, right?) have constructed a highly effective narrative about taxes. It is a governmentaphobia that enlists the very people hurt by its advancement. In many ways it has come to be taken for granted as common knowledge.

However, this does not mean that it is any way accurate, factual or backed by data, events or statistics. Here are some actual facts about our tax system to burst that fictitious balloon.

1. We don’t have a progressive tax system. A truly progressive tax system would ask those who are the most well-off in America to contribute the largest share of their income in taxes. Our federal taxes are progressive, but when you account for state, local and sales taxes, top-line taxation rate isn’t really progressive at all.

2. We’re one of the least-taxed countries in the world. Though the animating impulse of much of conservative politics is that we’re over-taxed, total government receipts are less in the United States than they are in any other member of the Organization for Economic Co-operation and Development, as a percent of GDP.

3. Not many companies pay the corporate tax rate—and some don’t pay any corporate taxes at all. Politicians and corporate lobbyists are fond of saying the US corporate tax rate of 35 percent is the highest in the world, which is technically true—but thanks to expansive tax loopholes, many corporations don’t pay nearly that much.

4. Some of your tax dollars are given to hugely profitable companies. Many companies have a negative tax rate—meaning they actually get money from the government. This can come in the form of federal tax breaks and other preferential treatment of certain financial instruments. Then consider the subsidies given directly to industry, along with the safety net programs some of these companies force employees to rely on, and the number gets quite big.

5. Meanwhile, some people are actually taxed into poverty. Many high-profile conservatives like to complain about their supposedly oppressive tax rates. But there’s one group—low-wage childless adults—who can literally be taxed into poverty.

6. Washington doesn’t like to address the deficit by raising taxes. There has been quite a bit of deficit reduction talk—and action—since 2008. Despite the fact that, as noted, government receipts in the United States are extremely low, a vast majority of the savings that DC has found has come from cutting things, not raising more revenue.

7. Much More Revenue Is Out There. In order to raise more tax revenue, corporations paying negative tax rates are a logical place to start, as are the very wealthy. They are the only ones seeing their income increase, rather than decrease.

The full article is available here

Wednesday, April 2, 2014

The Supreme Court’s Ideology: More Money, Less Voting - Ari Bermanon

In the past four years, under the leadership of conservative Chief Justice John Roberts, the Supreme Court has made it far easier to buy an election and far harder to vote in one.

The Court’s conservative majority believes that the First Amendment gives wealthy donors and powerful corporations the carte blanche right to buy an election but that the Fifteenth Amendment does not give Americans the right to vote free of racial discrimination.

These are not unrelated issues—the same people, like the Koch brothers, who favor unlimited secret money in US elections are the ones funding the effort to make it harder for people to vote. The net effect is an attempt to concentrate the power of the top 1 percent in the political process and to drown out the voices and votes of everyone else.

A country that expands the rights of the powerful to dominate the political process but does not protect fundamental rights for all citizens doesn’t sound much like a functioning democracy to me.

The full article is available here

Subscribe to:

Comments (Atom)