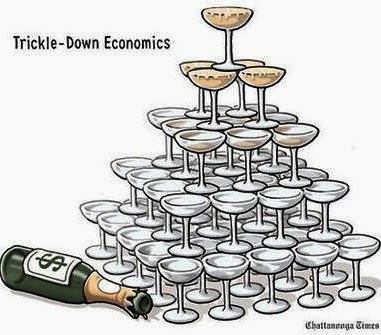

As productivity increased in this country, and employees provided more value, only those at the top that got the spoils.

If one watches corporate media, the impression is given that the free market as the best allocator of resources if left unfettered is the solution to all that ails the country’s economy. This god, the free market, will ensure that productivity and efficiency are rewarded.

Additionally one's wage is somehow proportional to their worth within the economy.

The wealth of most Americans has been in a state of stagnation since the institution of Ronald Reagan’s supply side economics (termed "voodoo economics" by George HW Bush) that America is still living under. Until this form of economics is disbanded and corrective action taken via the tax system, the middle class will continue to falter and the Plutocracy will continue its unfettered reign.

As productivity increased in this country, and employees provided more value, only those at the top that got the spoils. These are theories intent to keep a class system in which a very select few control most of the capital and the government.

Firstly, there is no free market. Corporations are grabbing patents or acquiring patents left and right however dubious the claims. Farmers are losing their ability to grow their crops free with their own seeds, because of cross pollination with genetically modified seeds of major corporations who own the patent on those seeds.

Secondly, while politicians are elected democratically, they are generally elected on false premises. The fact the mainstream news media is controlled by a few companies, means that the messaging heard by Americans are corporate-centric. As such, only politicians that toe the line tend to get the ability to get a message out that can get them elected.

Thirdly, the current tax structure mathematically ensures the demise of the middle class. This is a mathematical fact. The working person’s income comes mostly from wages. The wealthy person’s income comes mostly from municipal bonds and capital gains. Wages are taxed at up to 39% and municipal bonds interest is not taxed at all while capital gains are taxed at 15%. It is a mathematical impossibility that the wealthy will not continue to get a very disproportionate take of the pie.

The full article is available here